Template Features

This blog will show you how to use and get the most out of the Accounting Preparation Template.

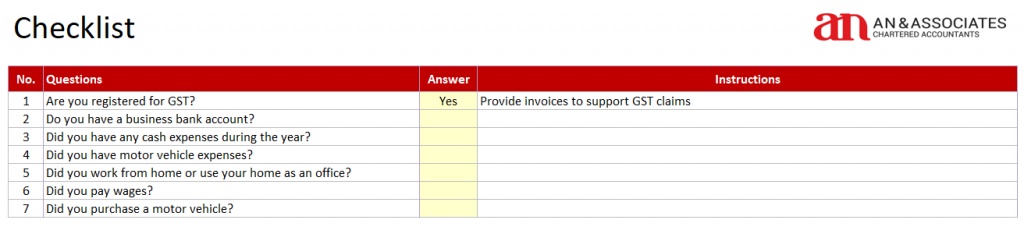

Checklist

Before starting to use the accounting preparation template, it is ideal that you go through the checklist. The checklist will help ask you questions about your business and instruct you on which sections of the template you will need to complete.

For the sake of this example, we are going to answer yes for all.

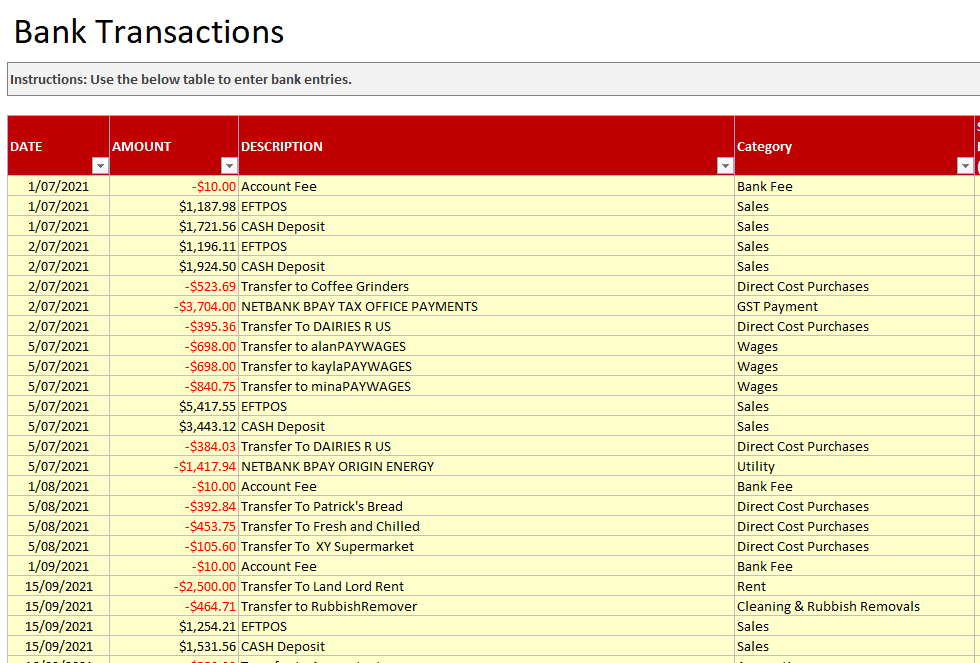

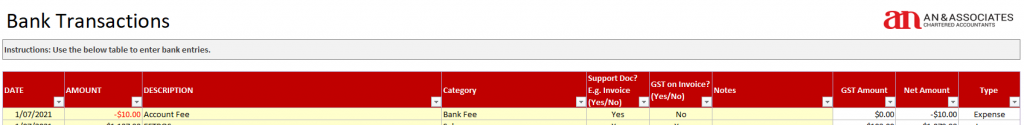

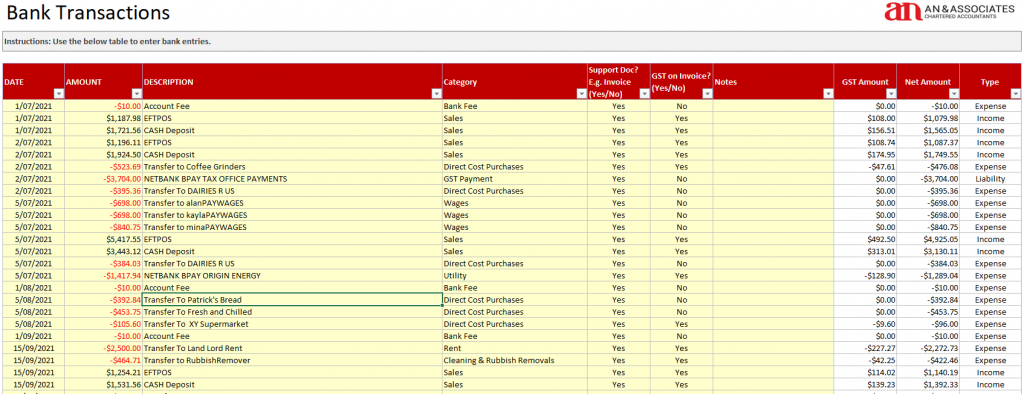

Banking Transactions

Your bank transactions will form the backbone of your tax return. Normally your accountant will request for business bank statements and classify each transaction to determine your income and expenses for the tax year. You can save money doing most of the work for your accountant.

This section of the template will help you classify every transaction on your bank statement. First, we need to get your bank transaction onto the template. From your online banking, download your bank transactions in CSV format for the date period you are working on.

On the Banking Transaction tab, you will need to copy and paste the “DATE”, “AMOUNT” and “DESCRIPTION” from your CSV file.

Things to consider:

- Every bank’s CSV file will be a little different from each other.

- Make sure incoming money is positive and spent money is negative.

Select the appropriate category for each transaction and indicate if you have an invoice for it. You can also add notes for your accountant if want to inform them something about the transaction.

Do this for all transactions for the period you are working on.

Let us help

If you require additional assistance – feel free to book in a chat with our team. This is a support call to help you make the most of this resource and will cost you nothing, just your time (which we know is valuable)!

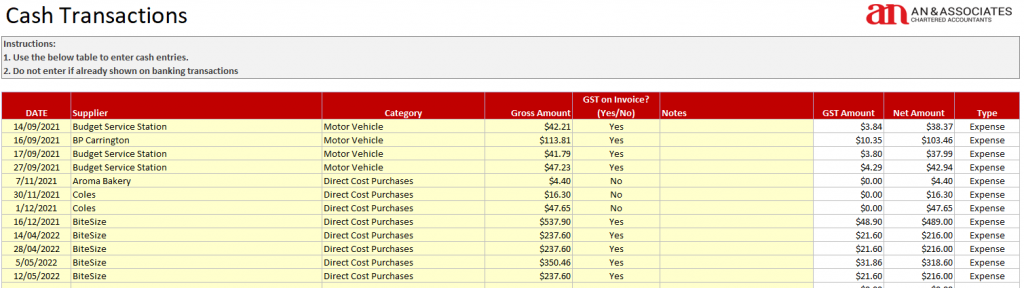

Cash Transactions

If you answered YES for Question 2, the Cash transaction worksheet is where you enter all of your cash transactions for the period.

Cash transactions are very easily missed. Many people miss out on these deductions because the expense was not paid from the bank account, it was forgotten about and therefore not provided to their accountant.

This is why we always recommend our clients to pay for business expenses using their business bank account.

But if you have to use cash for any reason, we recommend you take a picture of the invoice straight away using an online storage service such as Dropbox, One Drive or Google Drive. Or keep it in a small box. Make a habit of it.

At the end of the year, you can go through your online storage or box and enter all of the cash expenses you have incurred.

This will save you a lot of money on bookkeeping fees that your accountant won’t have to do.

Enter Date, Supplier’s Name, Category, Gross Amount and any extra notes for your accountant of every cash transaction you incurred for the period.

Motor Vehicle Logbook

If you answered YES for Question 3, go on the MVLogbook worksheet.

If you use a motor vehicle for both business and private use, you must be able to correctly identify and justify the percentage that you are claiming as business use. The ATO expects this. The percentage that is for private use isn’t claimable.

Many people get into trouble because they cannot substantiate and justify their claims to the ATO.

This logbook template will serve as your record to the ATO to justify the business-related expenses of your motor vehicle.

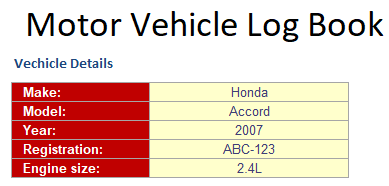

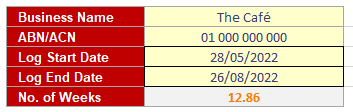

1. Enter your vehicle details.

2. Enter your business details and the start date of when you are logging your travels. You will need to keep at least 12 continuous weeks during the income year.

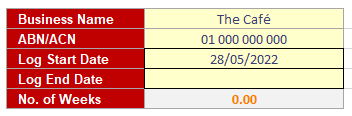

3. Enter your vehicle’s odometer reading as of your start date.

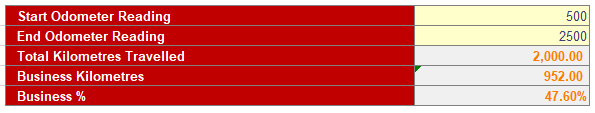

4. Record business-related travel trips with

- Date

- Description of Travel and

- Kilometres travelled

- Continuing recording for at least 12 continuous weeks.

5. Enter the end date after 12 weeks or more

6. Enter your vehicle’s odometer reading at the end of the 12 weeks.

7. The template will calculate and show the number of weeks you have kept the logbook. Make sure it is at least 12 weeks.

8. The template will show the business percentage you have used the vehicle and this will be displayed on the dashboard for your accountant.

Your template should look something like this after filling it in:

Things to consider:

- If you started to use your car for business-related purposes less than 12 weeks before the end of the income year, you can continue to keep a logbook into the next year so it covers the required 12 continuous weeks.

- This logbook will be valid for 5 years, but you may start a new logbook at any time.

- Travelling between your home and your place of business is considered private use unless you are a home-based business

Work from home Logbook:

If you have answered YES to Question 4, go to the WFMLogBook worksheet.

Working from home has become more common after the recent global pandemic. Many people were forced to work from or run their businesses out of their homes.

If you are claiming home expenses, your accountant will need to work out the percentage of your home which you use as a home office to account for expenses correctly. Similar to motor vehicle expenses, you are only allowed to claim the portion that is business related and you will need to justify the percentage used.

This template will help you record and track when you work at home during the year. Provide the total area of your property and the total area of your dedicated workspace in squared meters into the template.

Record a log of each day you worked at home.

Wage Summary

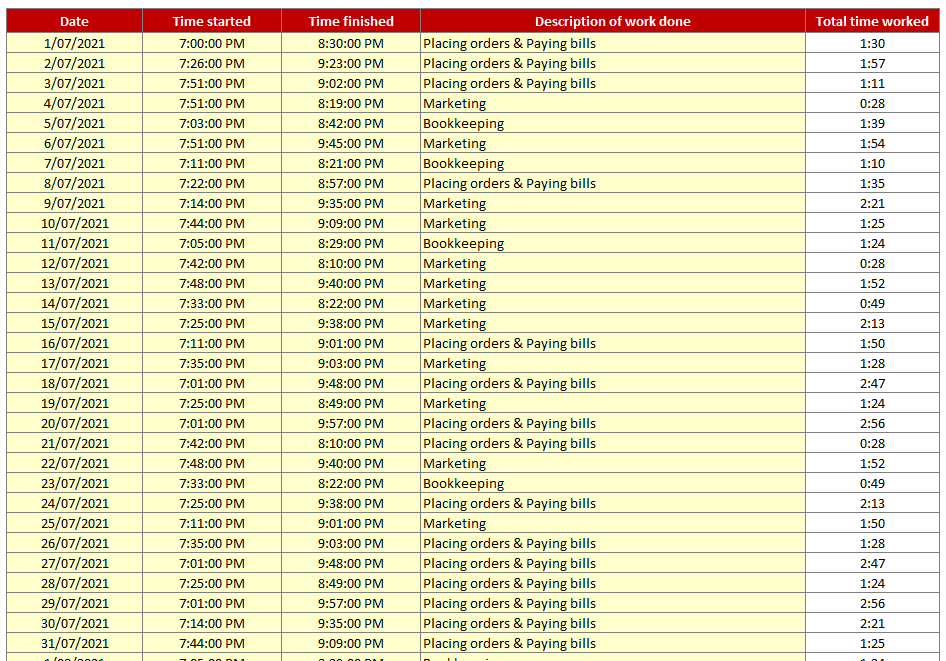

If you answered YES to Question 5, go to the WageSummary worksheet.

This wage summary template is not a payroll calculator. It simply records your payroll details for the period and the template will cross-check the total wages in your bank transactions and cash transactions to make sure you are not missing anything.

If you need help with calculating payroll, please ask your accountant or us for assistance.

Fill in the Date, Employee’s name, Gross wage and PAYG Tax withheld from each payroll transaction you have paid for the period.

After filling in the template, it should look like something like this:

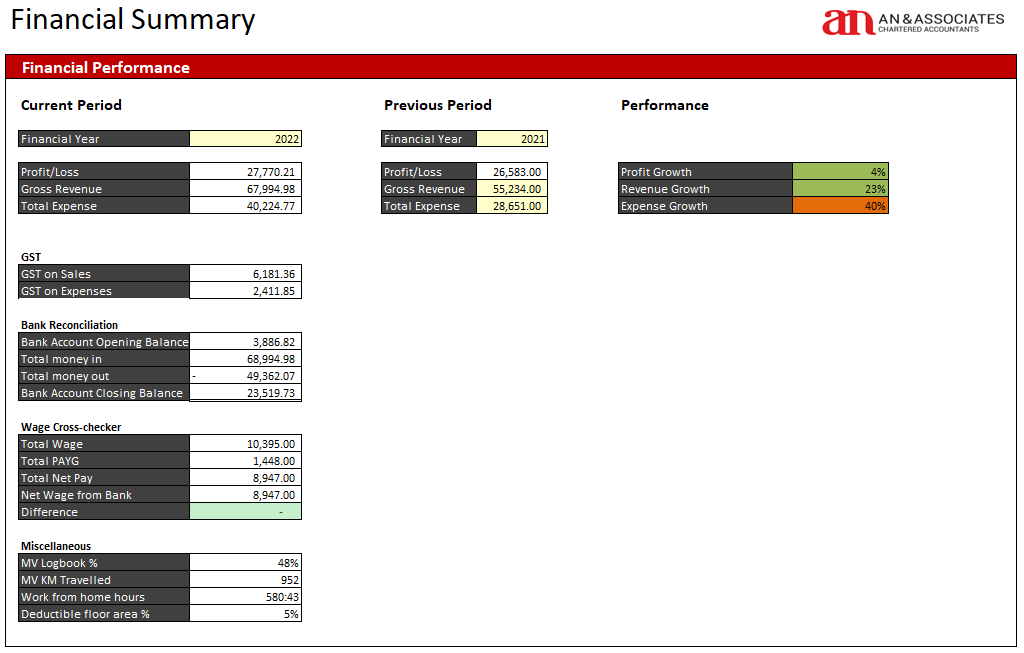

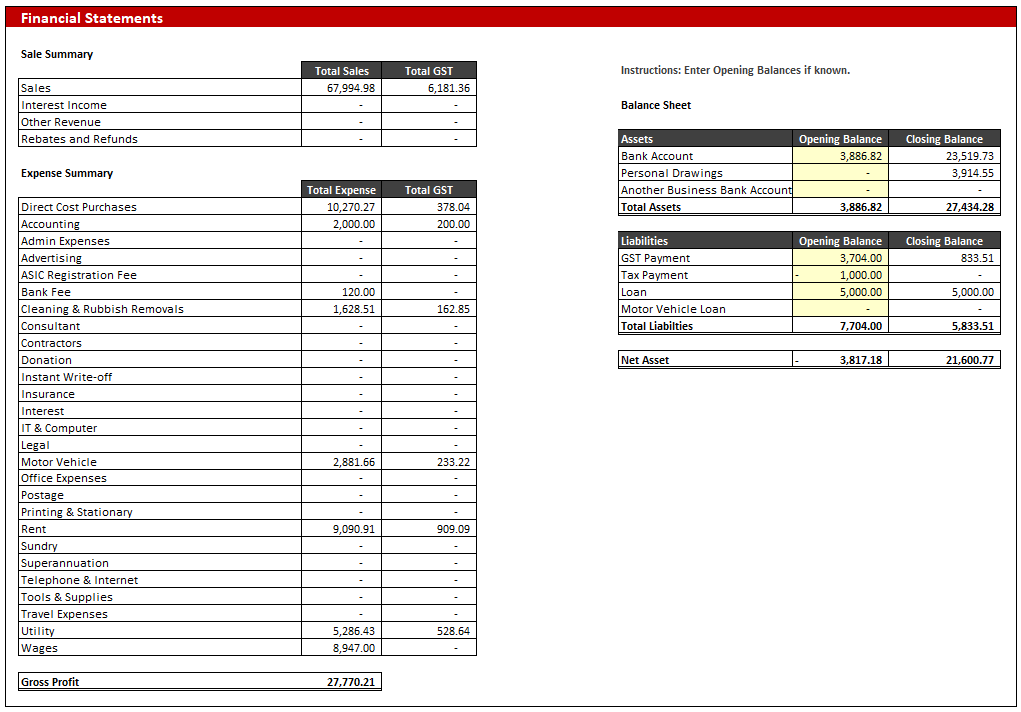

Dashboard

After completing the required worksheets, your dashboard will now be populated with valuable information that you can view and your tax accountant can use in your tax return.

Let’s start by entering the current year of this financial year, in this case, it’s 2022 and the previous financial year, 2021.

By entering your previous year’s Gross Revenue and Total Expense, the template will show your current year’s performance compared to your previous period. This is not required but is nice to know.

The Profit and Revenue Growth will appear green if it has increased compared to the previous period and will appear red if it has decreased.

The expense is the opposite, if your expense has decreased compared to the previous period, it will appear green and red if it has increased.

GST

The GST on your dashboard displays your GST summary for the period.

Total GST on sales and total GST on expenses.

This will help your accountant prepare your annual GST return or compare it with the BAS that has been previously lodged during the year. It may help highlight discrepancies that can be further investigated.

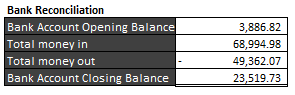

Bank Reconciliation

This part makes sure you have accounted for all bank transactions.

Enter the Opening Balance of your bank account in the Balance Sheet – Opening Balance section

Your Bank Accounting Closing Balance should match up with your bank statement closing balance.

If it doesn’t, something is missing. Go back to your Bank Transaction worksheet and double-check your transactions.

If you need help resolving this problem, call us.

The objective of the Bank Reconciliation is to make sure all bank transactions are accounted for by highlighting differences in the ending balance.

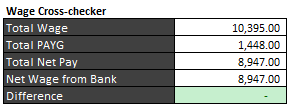

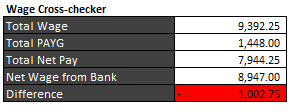

Wage Cross-Checker

This cross-checks the total net wage pay to the wages in your bank account and cash transactions.

If the total matches, the difference will be 0 and the cell will be green.

Red indicates there is a difference and something may be wrong.

Maybe missing wages in your bank statement or maybe missing wages in your wage summary.

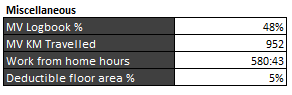

Miscellaneous

This displays Motor Vehicle and Work from home related information which will be very helpful to your accountant in preparing your tax return as the information required are there for them to use.

MV Logbook % is the percentage that you have used your motor vehicle for work/business-related purposes. The percentage has automatically been applied to all your motor vehicle expenses that were recorded in bank transactions and cash transactions.

MV KM travelled is displayed in case your accountant wishes to use the cents per KM method to account for your motor vehicle deductions.

Work from home hours is used to claim work from home deductions using the fixed rate method and short cut method.

Deductible floor area % is used to claim any home office expenses which must be apportioned according to the ATO.