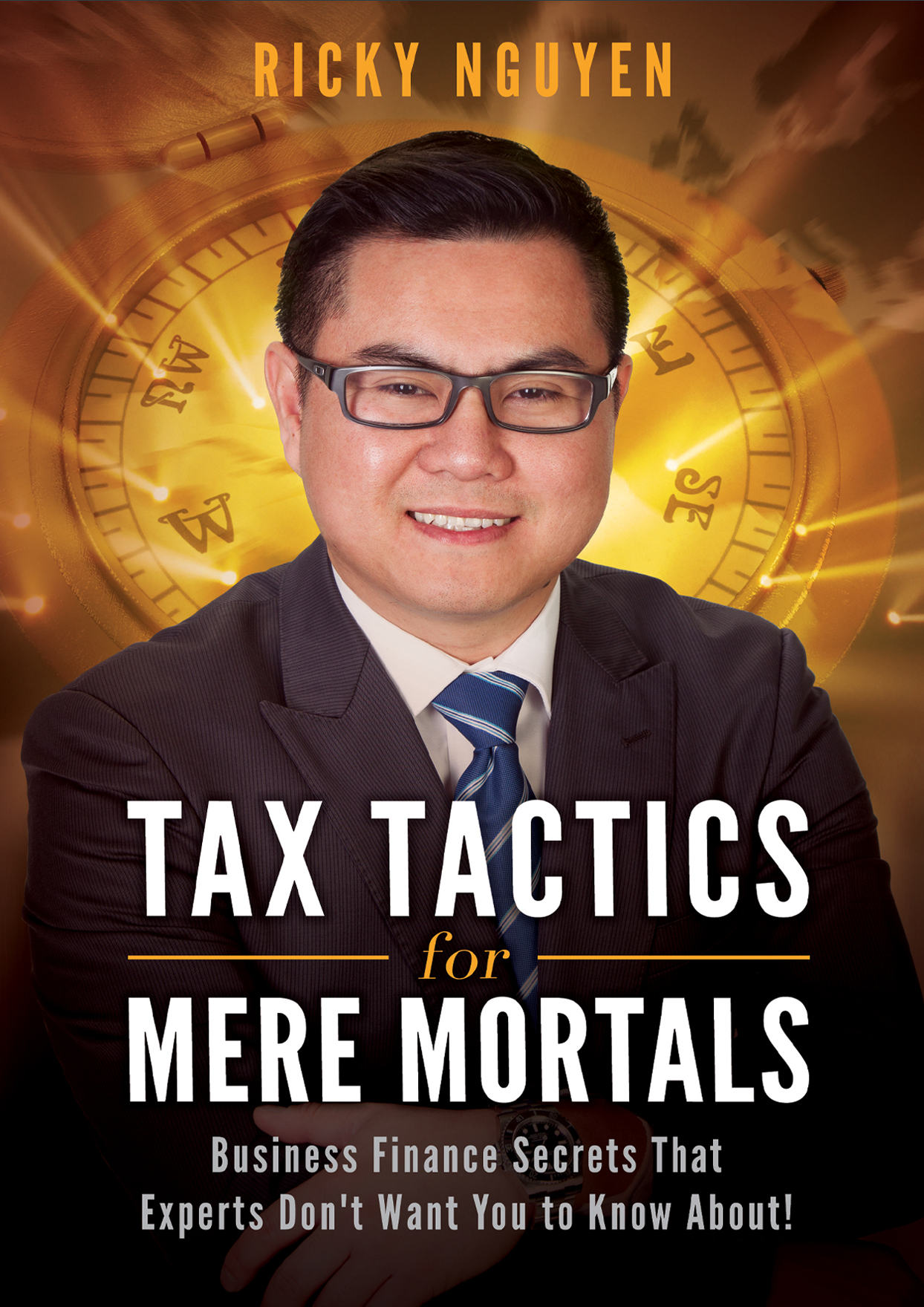

TAX TACTICS FOR MERE MORTALS

Business Finance Secrets That Experts Don’t Want You to Know About!

RICKY NGUYEN

AUTHOR | COACH | TRAINER | CONSULTANT

Announcing New Book

This book is aimed at business owners who want to take back control of their finances to make better, prosperous business decisions through understanding how our Australian tax system is used by the wealthy. How well do you truly understand the tax system? Do you really know how all the different tax laws could affect the way you do business? Or how about the rules and regulations in terms of what you can and cannot do? Are you too busy running your business that you’re simply forgetting to ask yourself, “How much tax am I really paying?”? This book will help you understand the relevant strategies that the wealthy business owners are taking advantage of their business – RIGHT NOW! Not only will these strategies help you save on tax, but ultimately, it will also help you stay compliant with the tax office so that you can take back control and focus on what’s most important in you business-growing it.

Don’t Miss Out

Limited Quantity Available

Sign up now to receive your FREE downloadable copy of Tax Tactics for Mere Mortals.

Our Services

Taxation

Personal Income Tax

Company Income Tax

Family Trust Income Tax

Professional Accounting

Business Structures

Buying and Selling Businesses

Business Plans

Preparation of Financial Statements and Income Tax Returns for your SMSF

Advisory for Establishing, Structuring, Contributions and Allowable Investments for your SMSF

An annual Audit of your SMSF

Learn How To

If you want to benefit from practical knowledge and take advantage of the tax system without having to go through the process of formal education, then this book is for you.

- Identify the first steps in starting your business.

- Gain that peace of mind knowing that you are doing the right things.

- Be prepared with powerful tax knowledge that can be implemented into your life, no matter what stage you’re in.

- Save in so many different ways in tax the ATO doesn’t want you to know about.

- Restructure your business and maximise your tax savings.

- Beat the tax man at his own game as you will be armed with some of the fundamental tactics used by the rich and wealthy in tax planning.

- Use an accounting system.

- Identify the difference between a contractor and employee.

What’s Included

Have that peace of mind in knowing that you are doing the right things by being equipped with a powerful tax knowledge that can be implemented no matter where you are in life.

- How the rich and privileged plan their tax affairs to beat the tax man in their own game.

- Tax planning strategies implemented by wealthy business owners.

- Ways to minimise tax within the boundaries of the law.

- The advantages of having a proper accounting system.

- Advice on how to stay compliant with GST legislations.

- The value of having a depreciation schedule.

- Strategies on how to sell an investment property.

- Understanding property and negative gearing.

- Business structures and the different tax impact it carries.

- Business deductions to help you maximise your savings.

- Real-life and practical examples.

- Getting the right advice from the right people.